Ida May Fuller, the first person to receive a Social Security check, worked for just three years before receiving her first benefit (in 1940). Over that time, the total taxes deducted from her salary amounted to a mere $24.75. Yet her first monthly check came in at $22.54, almost matching her entire contribution. Over the course of her lifetime, Fuller collected $22,888.92 in Social Security benefits. That’s equivalent to nearly half a million in today’s dollars and about 1,000 times what she had paid in taxes.

Some people continue to believe that Social Security functions as a mandatory savings system. But that’s not how this program works. Unlike a genuine savings account, where individual contributions accumulate and grow over time, Social Security’s structure is far more akin to a classic Ponzi scheme. Early recipients received far more in benefits than they ever paid in, while future generations face escalating costs to sustain the system.

Fuller’s case is a glaring example of how Social Security was never designed as a true savings system. Early beneficiaries, like her, reaped enormous gains because the program relied on payroll taxes from younger, growing workforces to cover payouts. Today’s workers, however, face an increasingly unbalanced equation. They are being asked to pay ever-higher taxes to support a system that offers far less in return than what earlier generations enjoyed.

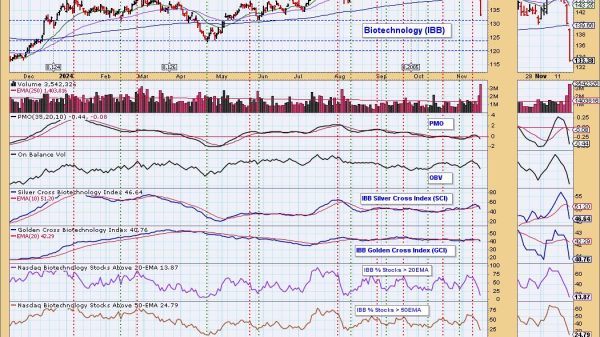

The math has fundamentally changed. In 1950, there were about 16 workers paying into Social Security for every retiree. Today, that number has dwindled to just 2.7 workers per retiree, and it’s projected to fall further to 2.4 workers per retiree by 2035. As the worker-to-retiree ratio shrinks, the system faces increasing strain. This demographic shift is one of the primary drivers of Social Security’s financing issues. Fewer workers supporting more retirees means higher taxes or reduced benefits—or both—to keep the program afloat.

The required changes are substantial. The Congressional Budget Office (CBO) estimates that the payroll tax would need to immediately increase from 12.4 percent to 16.7 percent to cover the program’s long-term actuarial deficit of more than $25 trillion. In numbers, a median worker earning $61,000 would need to pay an extra $2,600 in payroll taxes, bringing their total payroll tax burden above $10,000. On the flip side, the CBO projects that benefits would need to be cut by 23 percent in 2035 to meet incoming payroll tax revenues.

Another major reason that Social Security is financially unsustainable is because Congress repeatedly expanded benefits. From including spouses and survivors, to indexing initial benefits to wage growth, to adopting automatic cost-of-living adjustments, Congress has a long history of expanding Social Security, especially come election time.

Even Ida May Fuller herself grew concerned about the program’s unsustainable expansion. When Congress proposed yet another benefit increase in 1970, Fuller voiced her opposition. “It’s been raised as far as it ought to go,” she said. “Every time they raise it, they raise the amount taken away from the working people who pay into it and it’s just getting to be too much of a burden.”

Fuller’s warning rings true today. Social Security extracts significant resources from workers while offering them less in return. Most workers would be better off if Social Security didn’t exist and they had saved the money they paid in payroll taxes in accounts that they owned and controlled instead.

Alas, Congress has made millions of Americans largely dependent on Social Security for their retirement income by incentivizing them to work and save less than they otherwise would have. Transitioning away from this unsustainable system will be costly and politically painful. We can begin by reducing the growth of future benefits, increasing the age at which new beneficiaries can claim Social Security, and discontinuing cost-of-living adjustments for wealthier Americans to reduce their benefits slowly over time. Bolder changes would transition the program away from an earnings-related benefit to a poverty-targeted, predictable benefit. Significant benefit changes are necessary to reduce payroll taxes and enable workers to save more in private accounts that they personally own.

It’s time to confront the painful but necessary truth that no matter what story politicians told, Social Security has always been an income transfer program, not a savings system. Today’s Social Security is increasingly burdening future generations with the threats of higher taxes and inflation. A more effective approach would design Social Security as a safety net to prevent senior poverty while empowering workers to have greater control over their retirement security.

Next month I’ll publish a new Cato Policy Analysis that will dive deeper into exposing the myths surrounding the Social Security trust fund, revealing its true nature as a legal Ponzi scheme. This report will uncover the fiscal realities of Social Security’s financing challenge and highlight structural reforms that will reduce the rising burden on younger workers while protecting vulnerable seniors.