Palantir Technologies (PLTR) has occasionally appeared in the Top 10 StockCharts Technical Rank (SCTR) Reports. More recently, it has reached the top 5, making it a stock worth analyzing.

Palantir is a data analytics company that could benefit from the AI boom. On November 4, after reporting better-than-expected quarterly earnings, Palantir’s stock price rose 23% and has continued rising since then. The stock price is up over 250% this year. Given this performance and being added to the S&P 500 in early September, PLTR has a lot of upside potential.

FIGURE 1. PALANTIR IN THIRD PLACE. The stock’s recent price action has made PLTR a contender for a closer look.Image source: StockCharts.com. For educational purposes.

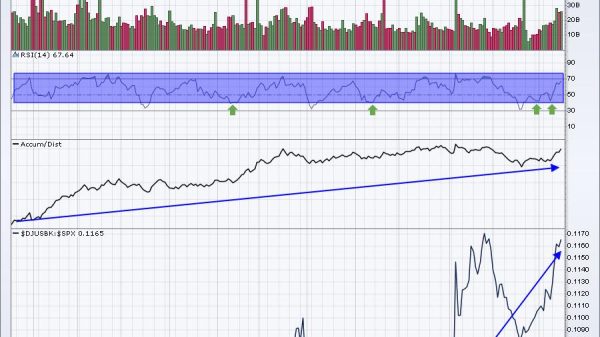

The weekly chart of Palantir stock paints the picture, and the dramatic price rise last week is very clear. After breaking through all resistance levels, the stock price is in a position to navigate uncharted territories. This makes it difficult to forecast Palantir’s stock price, but, given how far the stock price has come, it’s worth keeping an eye on it.

FIGURE 2. WEEKLY CHART OF PALANTIR STOCK. The stock price has broken through all resistance levels and is now in uncharted territory. How much higher can it go?Chart source: StockCharts.com. For educational purposes.

The daily chart (see below) shows that the uptrend is still going strong.

FIGURE 3. PALANTIR STOCK’s UPWARD TREND. The SCTR score has been above 80 since the early stages of the uptrend in the stock price. The relative strength index and full stochastic oscillator are in overbought territory.Chart source: StockCharts.com. For educational purposes.

Palantir is trading above its 15-day exponential moving average (EMA), its relative strength index (RSI) is well above the 70 level, and the full stochastic oscillator shows the stock is in overbought territory. Notice that the SCTR score has been above 80 since June 2024, when PLTR started its ascent. The bull run has been going on for a while, and recent price action shows that this stock has a lot of momentum.

When To Buy PLTR Stock

Palantir stock’s price action after its recent earnings report has been euphoric, so a correction would be healthy. When a stock is trading at its all-time high, it’s difficult to determine how deep a pullback would be. I am currently using the 15-day EMA as a potential support level, although I might have to tighten it depending on how the stock behaves in the next few trading sessions.

There are signs of a pullback surfacing. The red body of the last candlestick bar is the first since its last earnings report. Note the decline in trading volume while prices were rising. These are signs of a price decline, but, if the overall market remains bullish, the price decline may not be deep enough to reach the 15-day EMA. I might shorten it to a 10-day or even a 5-day EMA to use as a support level.

I would enter a long position when the price reverses on increasing volume and hold it until momentum decreases enough to justify exiting it. I would use a trailing stop to exit the position. Since PLTR is an AI-related stock, I would also monitor the performance of other AI stocks. If interest tapers, I would either avoid adding long positions or, if I own the stock, sell at least some of my positions.

The Bottom Line

I’ve added PLTR to my WatchLists ChartList (to organize your ChartLists, use the StockCharts ChartList Framework) and to one of my Dashboard panels to monitor it regularly. I wouldn’t want to miss an opportunity to ride Palantir’s rally.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.