President Biden is expected in his State of the Union address to propose raising the federal corporate tax rate from 21 percent to 28 percent. The administration says it wants to make “big corporations pay their fair share” and reverse the “massive tax giveaway to big corporations that Republicans enacted in 2017.”

A few thoughts.

Corporations pay income taxes, but the burden is passed on to workers, savers, and consumers. These individuals would pay the higher “share” that the administration is proposing. Corporations are just a politically convenient vehicle for collecting taxes on people.

In 2017, Republicans cut the federal corporate tax rate from 35 percent to 21 percent, but they also broadened the corporate tax base in various ways. Also, corporations respond to tax rate cuts by investing more and avoiding and evading taxes less. Thus, the statutory rate cut was not a “massive tax giveaway.” Indeed, federal corporate tax revenues have soared since the GOP reform from $297 billion in 2017 to an expected $569 billion in 2024. The latter figure is inflated for temporary reasons, and revenues are expected to fall to $494 billion in 2025, but that is still up from 2017—not a giveaway.

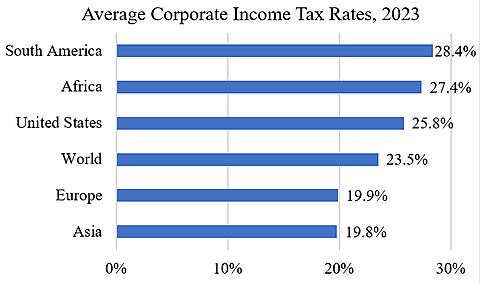

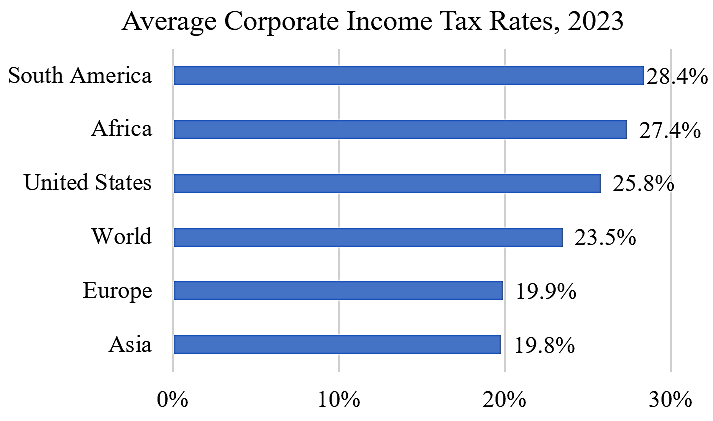

One reason to retain a lower corporate tax rate is that America competes globally for job‐creating investments. With average state taxes on top, the US corporate tax rate is 25.8 percent. That rate is already higher than the world average of 23.5 percent, according to the Tax Foundation, and the Biden proposal would further reduce our competitiveness.

Contrary to the administration, I think America should have the best tax environment in the world for entrepreneurs and business investment. The real “massive giveaways” are President Biden’s special handouts for politically favored industries such as energy, automobiles, and semiconductors. It’s better to have low and equal tax rates for all than subsidies for the few.

Read further Cato commentary on taxes from Adam Michel and Chris Edwards.